The first thing you'll want to make sure is that what you think is 'rent-to-own' isn't either a lease or a financing agreement. So, you'll want to either find your original contract, check a recent statement, or contact the store/creditor (whoever you're making payments to) to confirm. You don't have to tell them that you're looking for this information because you're planning to file bankruptcy if you don't want to.

What's the difference between rent-to-own, leased, and financed property?

Rent-to-own is exactly what it sounds like. You rent the property and while you have a certain ownership interest in the property, you don't "own it." Only after you've made all payments under the contract, do you become the owner of the property.

When you lease property, you're only renting it for a period of time. Once your lease term is up, you have to give the property back. For more on how leases are treated in bankruptcy, check out the Guide to Leases in Bankruptcy in our Learning Center.

When you finance property, you own it as soon as you bring it home from the store. But, the bank that loaned you the money for it has a "security interest" in the property. That’s why it’s called a secured debt. So, if you can't make all the payments, they can take the property back. You can learn more about how this works in bankruptcy in this article.

Rent-to-own property and your bankruptcy forms

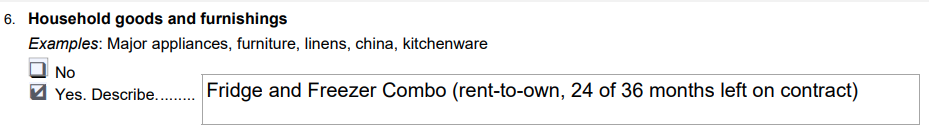

Remember that you have an ownership interest in your rent to own property, even though you don't fully own it yet. So, the first place you'll want to list it as an asset in your Schedule A/B. Since there's no way to separately indicate that you only own a percentage, it's best to explain it next to the item description. You can put a percentage, or simply note how many payments you have left. The point is to let the trustee know that it's not yours yet). It can look something like this:

Estimate the value of your ownership interest based on this information. If that's too complicated and you're not worried about going over on your exemptions, it's also ok to put the item's full value.

Some of these contracts actually say that you own 0% of the property until you're paid in full. But since it can't hurt as long as you're not coming up on an exemption limit based on your other belongings, it's ok to claim this property as exempt on your Schedule C.

List the contract on Schedule G

You'll have to list the contract on your Schedule G form. All you'll need for this is the name and contact information of the company you're renting the property from and what the contract is for. It's best to put the same information you have on your Schedule A/B in your explanation of what the contract is for.

What should I do if I want to keep these items?

If you plan to keep the property, you'll have to choose "assume" the contract on Official Form 108 (Statement of Intention). You'll also want to make sure that you list the monthly payment for this item as one of your monthly expenses on your Schedule J. Once your case is filed, send a copy of the Statement of Intentions to the company you're making payments to. They'll contact you if they need anything else from you after that.

What should I do if I don't want to keep these items?

If you want to get out of the contract and give the property back, choose to "reject" the contract on your Statement of Intention. Don't list the monthly payment on your Schedule J (since you won't have to make them anymore). You'll also want to make sure that the company the contract is with is listed on your Schedule E/F as an unsecured nonpriority creditor and appears on the creditor matrix you're submitting to the court. Once you’ve filed your case, send a copy of the Statement of Intention to the company to let them know that you want to give back the items. They'll let you know the next steps from there.

Comments

0 comments

Article is closed for comments.