You’ve filed for bankruptcy and you’re finally enjoying the peace that inevitably comes when the collection calls stop. Then a debt collector calls you or you receive a bill in the mail and you realize that you somehow missed a creditor in your bankruptcy forms. Don’t panic, this isn’t the end of the world. Everyone makes mistakes and this one is relatively easy to fix.

You’ll have to fill out some more forms and even pay a court filing fee of $32. But once you’ve added the creditor, you know you’ll be protected. If you don’t list a creditor or don’t amend your creditor schedules when you realize that you forgot to add someone, the debt you owe to the creditor may not be discharged. Looking at it that way, it’s worth it to go through all the steps to add a creditor after filing bankruptcy.

Many states follow a “no harm, no foul” rule when it comes to filers accidentally leaving out a creditor. These states generally say that if the trustee won’t be distributing funds to your creditors (because your case is a no-asset case), your debt will be discharged even if you didn’t list a creditor on your schedules. If you aren’t sure whether your case is a no-asset case and you can’t afford to spend $32 to pay the court filing fee for the amendment, you may be able to have a free consultation with a bankruptcy lawyer or use your bankruptcy court’s self help center or a similar resource in your area to find out whether you’re protected from the missed creditor.

What follows is a step-by-step guide on how to add a creditor after filing bankruptcy. The process for this is often very specific and differs from district to district. If you need to add one or more creditors after filing bankruptcy, the first thing you should do is check the court’s website or call the clerk’s office at the court where you filed your case. The court might have a how-to guide with specific instructions.

If you're an Upsolve user, you can use the amendment editor to generate this amendment. Click HERE for more information about the amendment editor.

Step 1: Identify the Type of Debt

The type of debt you owe the creditor you’re adding determines what form you’ll need to fill out.

Secured Debt

Can the creditor repossess the item(s) you purchased using this loan if you don’t make payments? If so, that’s a secured debt. Common examples are car loans, motorcycle loans, and mortgages.

Form to add a creditor you owe a secured debt: Official Form 106D, Schedule D

Priority Debt

Is the creditor a local, state, or federal government entity or your former spouse/partner? If so, the debt you owe them is most likely a priority debt. Common examples of priority debts are taxes, child support, and alimony.

Form to add a creditor you owe a priority debt: Official Form 106E/F, Schedule E/F, Part 1

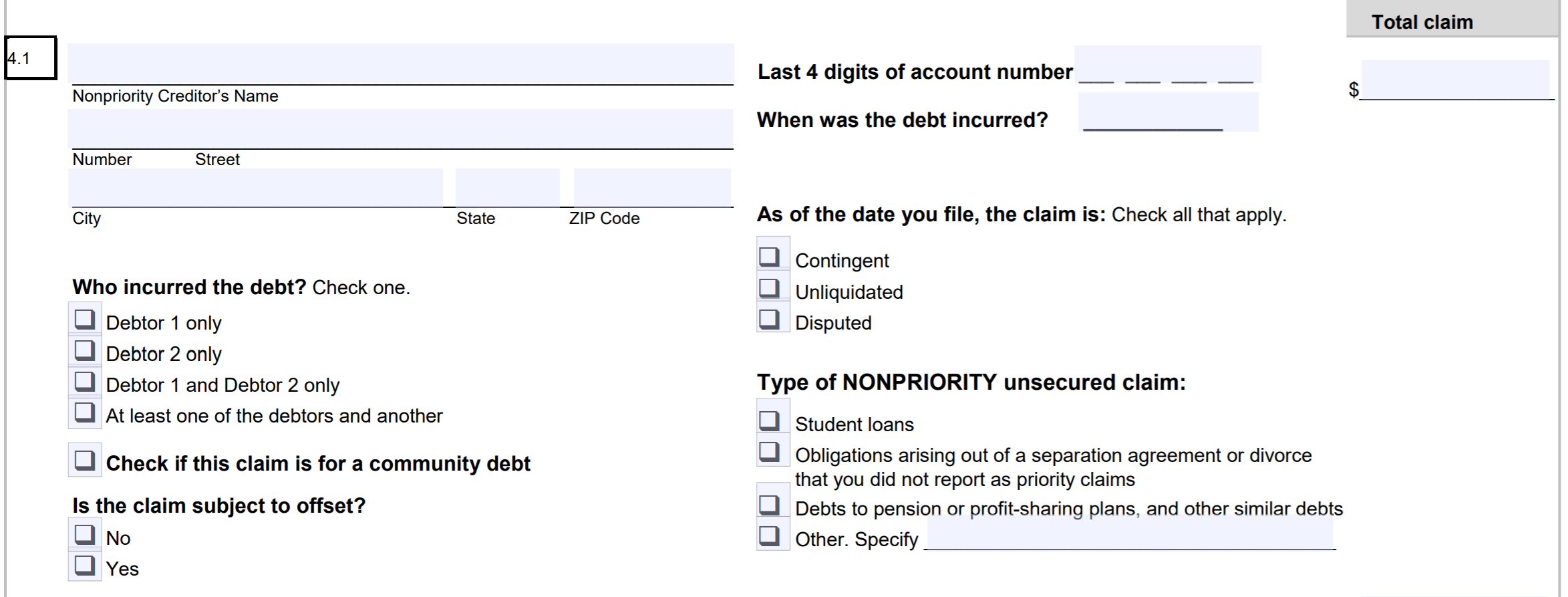

Unsecured Nonpriority Debt

These debts aren’t connected to a piece of property and the creditor doesn’t have priority status under the Bankruptcy Code. Debts that are neither secured debts nor priority debts are unsecured nonpriority debts. Common examples of unsecured nonpriority debts are credit cards, student loans, medical bills, payday loans, and personal loans.

Form to add a creditor you owe a priority debt: Official Form 106E/F, Schedule E/F, Part 2

Step 2: Collect the Forms

Using either the links above or the full list of required forms, download each form you need and save it on your computer. All forms are fillable PDFs, which means you can fill them out on your computer without special software.

In addition to Schedule D and/or Schedule E/F above, you also need:

- Official Form 106Sum, Summary of Your Assets and Liabilities

- Official Form 106Dec, Declaration About an Individual Debtor’s Schedules

- Any local forms the court may require. More on that later.

If you have a co-signer on the debt you're adding, you also need Official Form 106H, Schedule H: Your Codebtors.

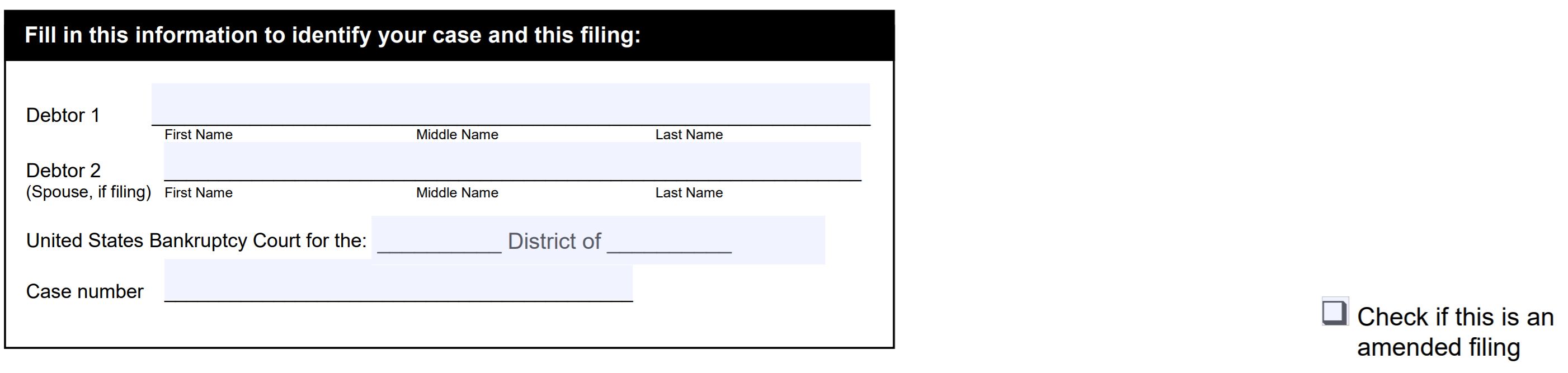

Step 3: Write Case Information on All Forms

You need to list certain information on every single page of each form. The first page of every form has a section that looks like this:

Since you’re preparing all of these documents for an amendment, make sure to check the box in the lower right corner to indicate that this is an amended filing.

You’ll need your name, the name of the bankruptcy court you filed in, and your bankruptcy case number. If you filed jointly with your spouse, make sure you include their name as well. You can find the name of the court and your case number on Official Form 309A, Notice of Chapter 7 Bankruptcy Case. If you can’t find that form, you can contact your local bankruptcy clerk at the courthouse to get all of your case information.

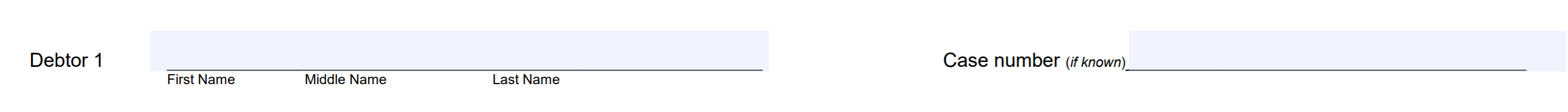

Forms that have multiple pages will have this at the very top of each page after the first page:

-

If you’re using the official fillable forms, adding your information on the first page will automatically update this information on all of the following pages. If you’re filling everything out by hand or using non-fillable forms, you’ll have to make sure to add this information on every page.

Step 4: Fill Out Forms

Here’s how to fill out the forms to add a priority debt, an unsecured nonpriority debt, or a debt that has a co-signer.

Adding a Priority or Nonpriority Unsecured Debt

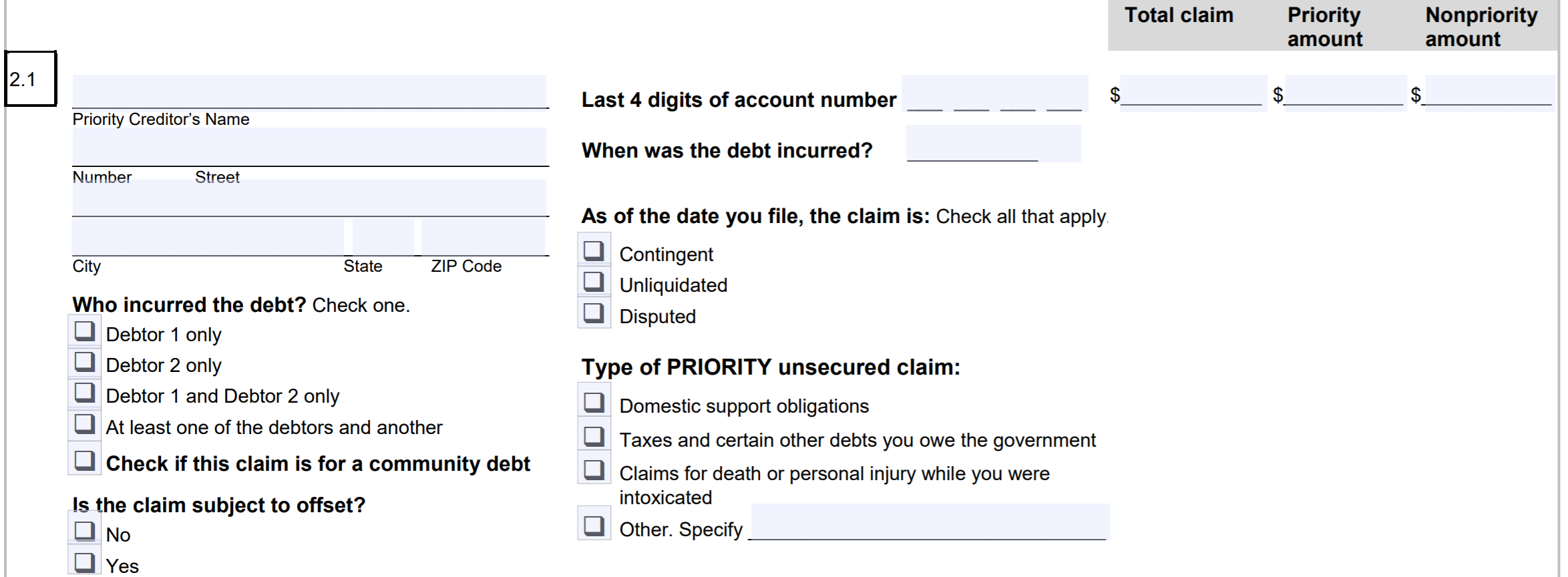

If you’re adding a priority debt on Schedule E/F…

-

- Check “yes” in response to Question 1 in Part 1.

- Add the creditor in line 2.1.

- If you’re not sure how much of the claim is priority vs. nonpriority, it’s ok to only put a total claim amount.

- Check the boxes as applicable.

- If you aren’t sure what “When was the debt incurred?” means you can read our help article on that.

- List the amount of the debt under “total claim.”

- Check the boxes as applicable.

Now, update the total on Schedule E/F.

Once you’ve added all necessary debts as outlined above, make sure to update the totals in Part 4, Question 6. Only include the amounts listed in the amendment you’re filing.

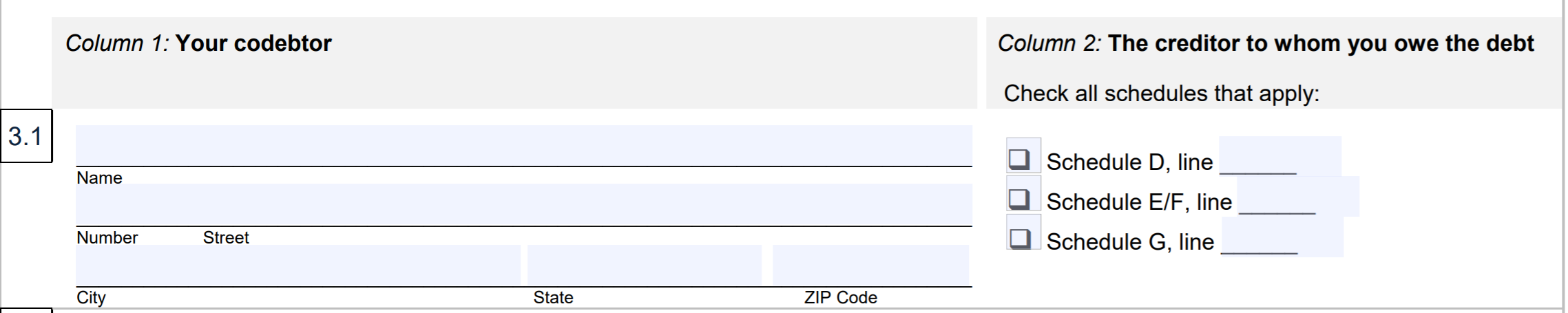

Updating Schedule H if You Have a Co-Signer on the Debt You’re Adding

If you’re the only one responsible to pay the debt you’re adding, skip this part. If both you and the co-signer are responsible for paying the debt, do the following:

- Check “yes” in response to Question 1.

- Copy response to Question 2 from the original Schedule H you previously submitted to the court.

- Add the co-debtor’s information in response to Question 3.1.

- Add the name and address of your co-signer or co-debtor in Column 1, and identify the Schedule and Line the co-debtor is attached to.

- If you’re adding only one unsecured creditor, you’ll check the box for “Schedule E/F” and list the number line the creditor appears on next to the line. It’ll look something like this by the time you’re done:

Complete the Summary & Signature Pages for Any Debts Added

The summary sheet will act as a cover sheet for your amended schedules, so the court gets a complete picture of your updated information.

- Start by pulling the original summary sheet you submitted to the court.

- Answer Question 1 by copying information from the original summary.

- Complete Part 2 by increasing the amount shown in the original summary based on your amendment.

- Example: Your original summary sheet shows a total of $23,450 in response to Question 3 and your amended Schedule E/F adds a new debt of $2,000. Your response to Question 3 in the amended summary will be $25,450 ($23,450 + $2,000).

- Answer Questions 4–8 by copying information from the original summary.

- Answer Question 9 by increasing the amount shown in the original summary based on your amendment.

Finally, don’t forget to complete, print, and sign the signature sheet to submit along with your amended schedule(s).

Step 5: Create a Creditor Matrix

The creditor matrix is the document that lists all of your creditors' addresses in the style of a mailing label. The bankruptcy court uses it to create the documents to mail to all of your creditors when they need to be notified about something happening in your case. Each court does this differently, so the court handling your bankruptcy case probably has its own system, including how they want you to format this list.

In light of that, you’ll want to check out the court’s website or call the clerk’s office. Explain that you’re trying to find information about creating and filing a creditor matrix for an amendment to your Schedule E/F. Make sure to follow the instructions carefully, as the clerk may not accept your filing if you don’t meet the specific requirements.

If you need to learn how to create a .txt file for the court, check out this how-to guide.

Finally, since you won’t sign the creditor matrix, you have to prepare a verification of the creditor matrix. You can use the same form that you prepared for this purpose when you first filed your bankruptcy case. But make sure you add your case number and either check a box or otherwise indicate that this is for an amendment to your creditor matrix.

Step 6: Complete Any Required Local Forms

Some districts have created a cover sheet, certificate of service, or other supplemental forms you’ll need to file with the court when you add a creditor after filing bankruptcy. Check your local court’s website or call the clerk’s office to find out what local forms you’ll need to amend your Schedule E/F. In some cases, it may make sense to complete this step at the courthouse while you’re filing your amendment, but the best practice is always to bring all the forms you need. Since this varies from district to district, make sure to follow the instructions from your court.

Step 7: File the Amendment

Go to the courthouse or send your amended schedules via USPS to file your amendment. There is a $32 filing fee for amending creditor schedules. The fee is the same regardless of the number of creditors you add. Not all bankruptcy courts accept cash, so if you plan on using cash to pay the court filing fee, make sure to check that it’s allowed by calling ahead. If you’re mailing in your amendment, don’t send cash. Instead, include a cashier’s check or money order, and be sure to write your name and case number in the memo field.

Upsolve Users: For instructions on how to file the amendment generated for you by Upsolve, follow these filing instructions and links provided in your my.upsolve account.

To summarize… while you should do your best to make sure that all of your creditors are listed on your Schedules D and E/F and your creditor matrix before you file for bankruptcy, it’s not a complete disaster if you realize you missed one. No one is perfect, and as long as you take the proper steps to correct the error, everything will be fine. Finally, depending on your district, if your trustee isn’t distributing funds to your creditors, the unlisted debt may be discharged even though the creditor didn’t get notice of your case.

Comments

0 comments

Article is closed for comments.