Once your case is filed and the bank knows that you wish to reaffirm your car loan (based on the information you provided on the Official Form 108, the Statement of Intentions), they will send you a reaffirmation agreement to review and sign.

The reaffirmation agreement will be mostly filled out, with all of the information about the loan and the vehicle securing the loan already in the appropriate spots. There are a few things that you will have to complete on your own, however, and that can be a little confusing. Let’s take a look at how to fill out your reaffirmation agreement, one step at a time.

Reaffirmation Agreement Coversheet

The coversheet is a summary of the terms of your reaffirmation agreement. It’s required for every reaffirmation agreement.

The bank will complete questions 1 - 5 on the coversheet. This is the best place to make sure you know the terms you’ll be agreeing to, including the remaining balance on the loan, the interest rate, the amount of the monthly payments, how many payments are left, and whether the debt is nondischargeable. You can find all of this information in questions 1 - 5 on the coversheet. In a typical car loan reaffirmation, the “no” box should be checked in response to question 5. You will have to complete questions 6 - 11.

Question 6a - 6d: Income and expenses reported on Schedules I and J

Questions 6a - 6d ask for information from your Schedules I and J. To complete this part, you’ll need to have these schedules (as filed with the court) in front of you. Then you can simply copy the information from the schedules into the corresponding spots on the coversheet:

- Question 6a - use the number from line 12 on your Schedule I (Income)

- Question 6b - use the number from line 22c on your Schedule J (Expenses)

- Question 6c - check line 17 on your Schedule J to find out whether your car payment for this car is listed. If it is, the answer to 6c is 0 and you can find the answer to 6d in line 23c of your Schedule J. If it’s not listed, add your car payment as shown in response to question 2 on the coversheet in line 6c.

- Question 6d - Subtract lines 6b and 6c from 6a. Essentially, you’ll be performing this calculation:

- Income - expenses - car payment = answer for 6d

- Example 1: $4,000 - $3,500 - $400 = $100

- Example 2: $4,000 - $3,700 - $400 = [- $100]

Questions 6e - 6h: Income and expenses stated on the reaffirmation agreement

The purpose of questions 6e - 6h is to determine whether your income or expenses have changed since your bankruptcy case was filed and if so, how.

Question 6e monthly income. To answer this question, ask yourself the following questions:

- Did I get a raise since I filed my bankruptcy forms?

- Did I change jobs since I filed my bankruptcy forms?

- Did I lose my job since I filed my bankruptcy forms?

- Did my hours get reduced since I filed my bankruptcy forms?

If the answer to all of the above is “no” then your income hasn’t changed and you can list the income shown on line 6a as your monthly income in 6e. If you’ve answered “yes” to any of these questions, then your income has changed. Calculate your new monthly take-home income (your net income) and list the result in response to question 6e.

Question 6f - monthly expenses. When it comes to determining whether your expenses have changed, go through the same exercise, but ask yourself whether anything has changed in your life or your family’s life that affected your expenses.

Remember that your expenses can be broken into fixed and variable costs. Unless there’s been a change in your household size (someone moved in or out), it’s unlikely your variable expenses have changed since you filed your forms. Since it’s only been about a month since your case was filed, the same is generally true for fixed expenses. If nothing has changed, you can list the expenses shown on line 6b as your monthly expenses in 6f.

Question 6g asks the same thing as question 6c. To answer this question, check line 17 on your Schedule J to find out whether your car payment for this car is listed. If it is, the answer to 6g is 0. If it’s not listed, add your car payment as shown in response to question 2 on the coversheet in line 6g.

To answer question 6h, subtract lines 6f and 6g from 6e. Essentially, you’ll be performing this calculation:

- Income - expenses - car payment = answer for 6h

- Example 1: $4,000 - $3,500 - $400 = $100

- Example 2: $4,000 - $3,700 - $400 = [- $100]

Note: If your income and your expenses have not changed, your answer to 6h will match your answer to 6d.

Good news! The hardest part is done!

Questions 7 and 8 - Explaining what changed

- If your income and expenses didn’t change, simply check “no” in response to questions 7 and 8.

- If your income changed, check “yes” in response to question 7 and then explain why/how your income has changed.

- If your expenses changed, check “yes” in response to question 8 and then explain how your are now different.

Question 9 - Will making your car payment be a hardship for you?

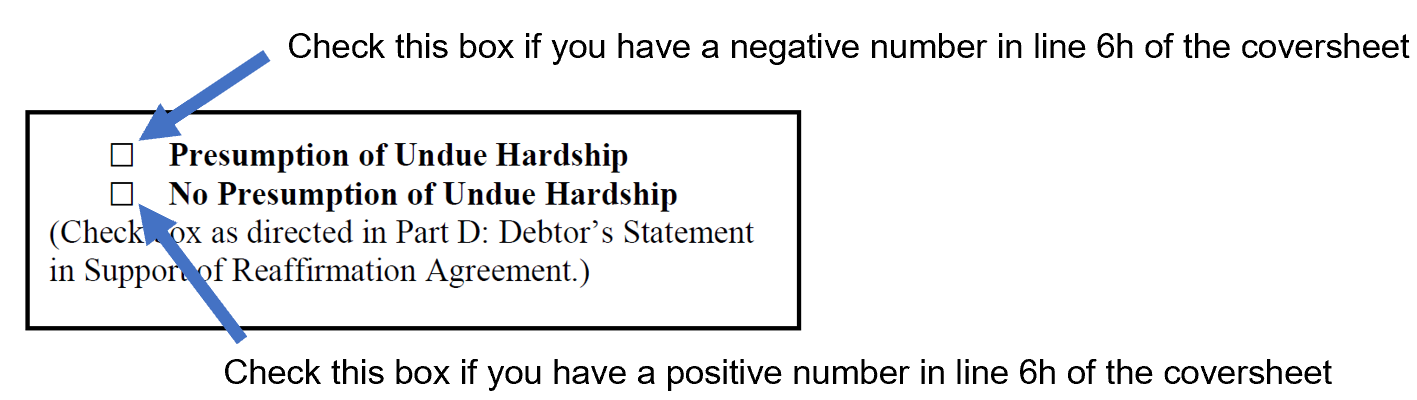

If your income is greater than your expenses, and you have a positive number on line 6h, check “no” in response to this question. The person in Example 1 above would check “no” here.

If your expenses are greater than your income and you have a negative number on line 6h, check “yes” in response to this question. The person in Example 2 above would check “yes” here.

If your expenses are greater than your income, a “presumption of undue hardship” exists. Essentially, this means that at least on paper, it looks like making the monthly car payment may be a hardship because you don’t make enough money to cover your expenses. This is actually quite common, so if this is you, don’t freak out. Rather, explain to the court why and how you think you’ll be able to make timely car payments anyway in response to question 9.

Question 10 - Certifying the information

If you answered “yes” in line 7, 8, or 9, you have to sign a certification that the information you provided in response to these questions is true and correct. If you answered “no” to all three questions, no signature is necessary.

That’s it! Assuming you filed bankruptcy pro se (without a lawyer) you’re done with the Reaffirmation Coversheet and ready to move on to the next step: the Reaffirmation Agreement.

The Reaffirmation Agreement

The good news is that you’ve done all the heavy lifting already. The Reaffirmation Agreement won’t ask you for information you haven’t already put on the coversheet. It’s broken into 4 parts.

Part A - Disclosures and instructions

This will be filled out by the bank. Your job is to review it carefully as it states the full terms of the agreement, provides instruction to the debtor (you), and answers to some frequently asked questions.

Part B - Reaffirmation Agreement

Part B is where you sign the reaffirmation agreement. Simply sign and date where indicated.

Part C - Certification by Debtor’s Attorney

If you filed your case pro se - without an attorney - you can ignore Part C. If you have an attorney representing you in your case, ask them about Part C.

Part D - Debtor’s Statement In Support of Reaffirmation Agreement

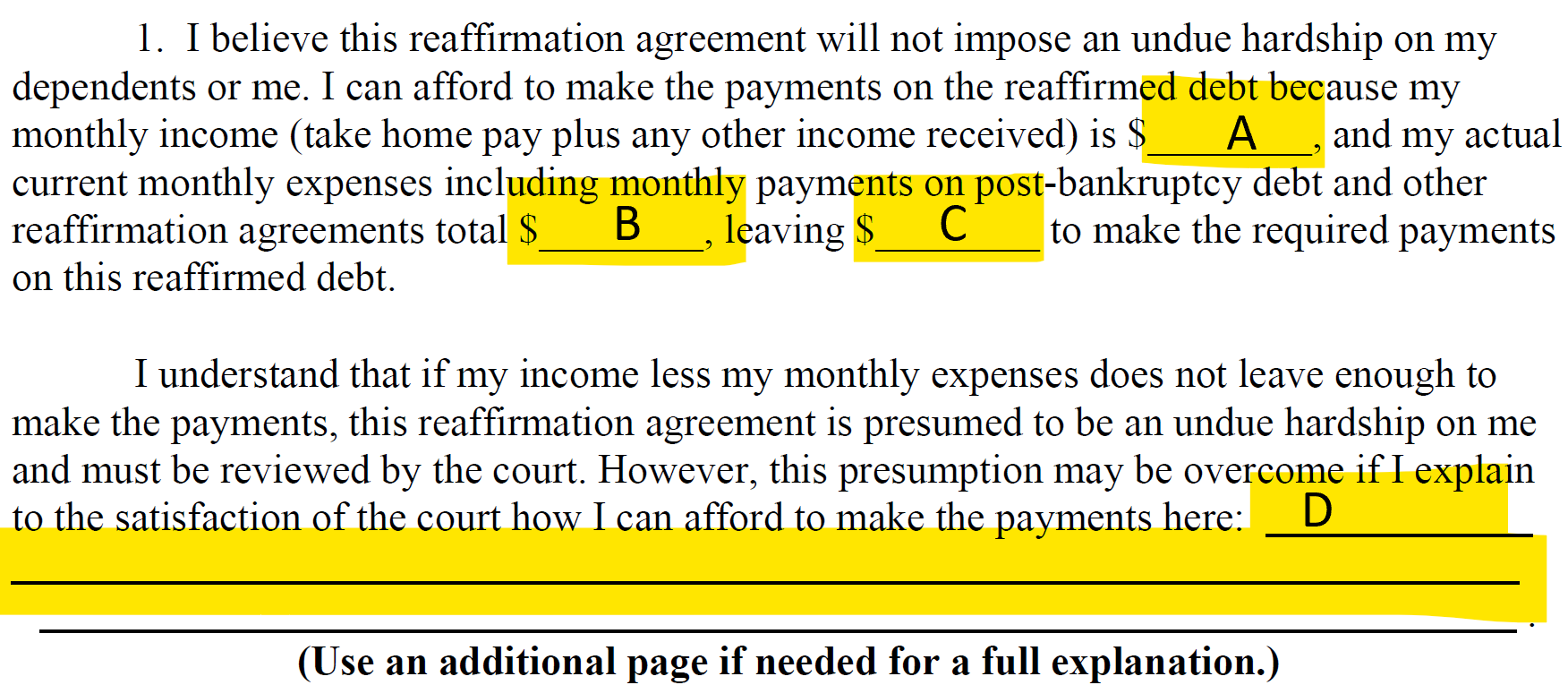

If your loan is not through a credit union, you only have to worry about questions 1 and 2 of Part D. Question 1 looks pretty intimidating but, having completed the coversheet first, you already have all of the information you’ll need. Carefully review the statement, and determine the answers for the blank spots using the information you’ve gathered on your coversheet. Unfortunately, it does not track the coversheet exactly, so you’ll have to do a little bit of math for the first three blanks.

A = your income = the number listed on line 6e of the coversheet.

B = your expenses, not including the car payment = the number listed on line 6f of the coversheet minus the number listed on line 6g of the coversheet.

C = A minus B = showing your income minus your expenses without the car payment.

D, if the number shown in C is greater than your car payment, put “N/A.”

D, if the number shown in C is less than your car payment, add the information you listed on line 9 of the coversheet here.

Question 2 of Part D is pretty self-explanatory - review the statement and sign and date where indicated.

Part E - Motion for court approval

Carefully review the Motion and sign and date where indicated at the bottom of the motion. Check this box if you didn’t have a lawyer helping you with the reaffirmation agreement:

If your expenses are greater than your income (i.e. if you have a negative number in line 6h on your coversheet), also check this box:

You’re almost done! Go back to page 1 of the Reaffirmation Agreement and check the appropriate box in the top right corner of the page.

The next step

That’s it! You’re done and ready to send the coversheet and all parts of the reaffirmation agreement back to the bank, carefully following the instructions from the bank. They will submit the agreement to the court and the court will let you know when your reaffirmation hearing, the last step in the process, will be shortly after that.

Comments

0 comments

Article is closed for comments.