Even though the term “dependent” is defined by the tax code, that definition does not perfectly translate to what shows up on the bankruptcy forms. The bankruptcy forms draw a picture of your financial situation for the court. The court wants to make sure that granting you a discharge is fair by reviewing your household income and expenses.

The number of dependents appears on Form 106J (Schedule J). Form 122a-1 (the Means Test) asks how many people live in your household, which generally means the same thing as how many dependents do you have.

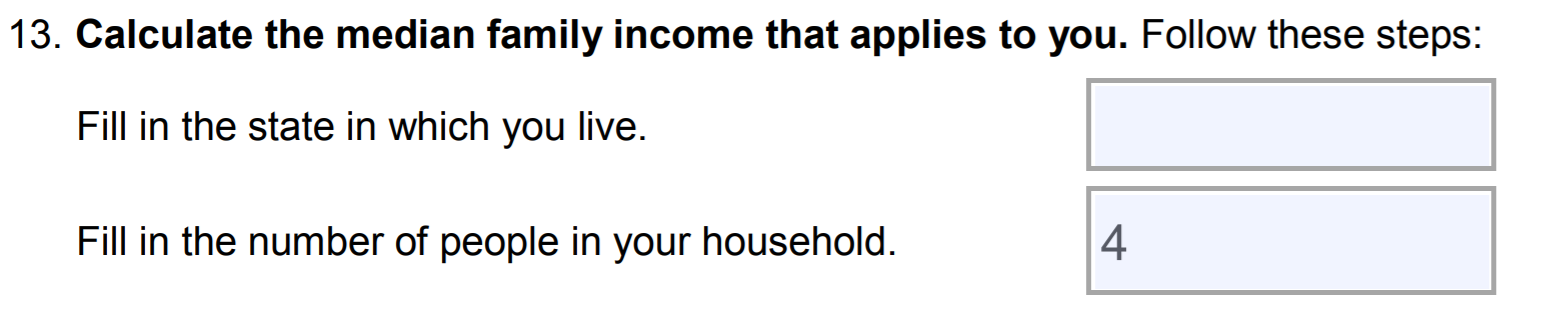

TIP: When reviewing your bankruptcy forms, check the “number of people in your household” as shown in part 2 of Form 122a-1 (Question 13). In most cases that number is equal to the number of your dependents listed on Schedule J plus your spouse (if any) and yourself.

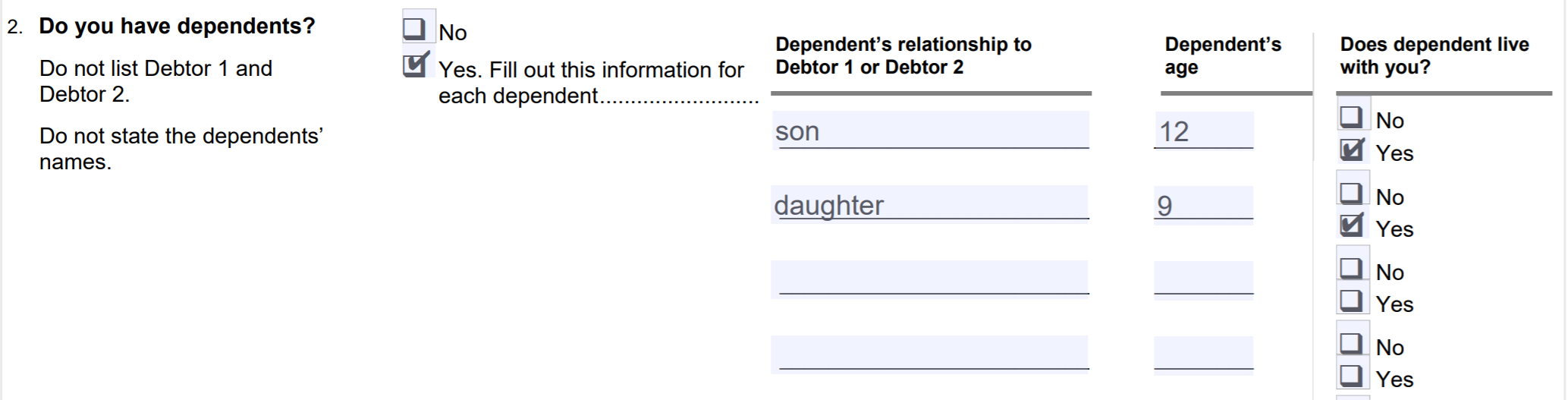

Example: The debtor is married and has 2 minor children. The family lives together. Their Schedule J looks like this:

Part 2 of the Means Test on Form 122a-1 looks like this:

The number of dependents is important

How many dependents you have is important for the court because it’s the only way to tell whether your expenses are reasonable.

For example, no one will question a $1,000 / month grocery expense if the filer is a parent of 4 teenage boys. But, if a single guy in his late 20s spends $1,000 a month on groceries for himself, it definitely looks like that guy should cut back on his expenses and pay back some of his debt through Chapter 13 bankruptcy.

In most situations, simply looking at who is sitting around the dinner table on a regular basis is all that is needed to figure out how many dependents you have. Anyone who relies on you for food and housing and does not have a source of income themselves is a dependent.

So, if the single guy from the example above actually has his 3 teenage brothers living with him full time, and they rely on his income to pay monthly expenses, he should list his brothers as dependents on his bankruptcy forms, whether he claims them on his tax return or not. That way the court and anyone else looking at his bankruptcy forms can easily see that he is not being careless about his spending.

Frequently Asked Questions Involving Dependents

Who should not be included even though they live with you? Anyone who pays their own way. If your living expenses are the same whether the person is staying with you or not, they are not members of your household for purposes of the means test or dependents on your Schedule J.

Minor Children

My child lives with me full-time but receives child support that covers their monthly expenses. Are they a dependent? Yes, because you pay your child’s living expenses. You account for the child support you receive on Schedule I.

My child does not live with me full-time but I pay child support. Example: If your child stays with you only on weekends. If your child is not with you for at least 50% of the time, you probably should not list them as a dependent on your Schedule J. Your child support is listed as a separate deduction on Schedule I (if payments come directly from your paycheck) or as an expense Schedule J (if you pay the child support directly).

I care for my niece and nephew who live with me full-time. Yes, if the expenses listed on your Schedule J include their expenses. But, make sure to include any financial support you may receive for taking care of them as income. This includes contributions from their parents and government benefits.

Adults

My adult child is away at college full time but stays with me during breaks. If your living expenses are the same either way, they’re not dependents for purposes of your Schedule J and should not be included as a member of your household on the Means Test. On the other hand, if you’re supporting them by paying some of their expenses while they are away, you may be able to list them as a dependent on your Schedule J. Whether you can count them as a member of your household on the Means Test depends on a variety of factors, including the prevailing law in your district. If you are in this situation, consider speaking to a bankruptcy attorney about your options.

Can I list my boyfriend, girlfriend or unmarried partner as a dependent on Schedule J? Yes, if the expenses listed on your Schedule J include their expenses. But, make sure to list any contributions they make to your household expenses as income on your Schedule I. This includes amounts they pay to third parties to cover bills that are included in your household expenses.

Is my spouse or legally recognized domestic partner who does not work a dependent? No, spouses are not typically listed as dependents on Schedule J. As long as they live with you, they do count as a member of your household and your monthly living expenses can account for that. As long as you provide the requested information about your spouse in the questionnaire, they will be included in the number of household members on the Means Test form.

Is my married spouse or legally recognized domestic partner that is employed a dependent? No, spouses are not typically listed as dependents on Schedule J. You do have to disclose their income on your Schedule I. As long as they live with you, they do count as a member of your household on the Means Test as long as you provide the requested information about your spouse in the questionnaire. You’re also able to include their expenses on your Schedule J, unless they live somewhere else. In that case a separate Schedule J showing their monthly expenses is required.

My parents live with me full-time. They do receive income from benefits. If your living expenses would be the same if you were not caring for your parents at home because their benefits cover their food, medical expenses and other bills, they’re not dependents for purposes of your Schedule J. On the other hand, if you’re supporting them by paying some of their expenses, you may be able to include them as a member of your household.

Conclusion

It’s important to correctly calculate your household size on the Means Test and list all dependents on your Schedule J. If your situation is complicated and it looks like you’ll only qualify for Chapter 7 if you include every single person you possibly can as a dependent, consider speaking to a bankruptcy attorney about your case. Including persons who do not qualify as a dependent on your bankruptcy forms just so you can pass the Means Test does not work and you’re risking your discharge by doing so.

Comments

0 comments

Article is closed for comments.