Filing bankruptcy allows you to eliminate unsecured debts like credit cards, car loans, bank loans, and medical bills. While eliminating this debt will help your household budget, there’s also a lot it doesn’t change. You’ll still be responsible for rent, utilities, insurance, groceries, and all your other living expenses.

Importantly, filing bankruptcy doesn’t change your income. If you made $0/month before filing your case, you’ll still be making $0/month afterward. This means that simply stopping paying your unsecured debt so you can make sure your necessities are taken care of will have the same short-term effect as a bankruptcy filing.

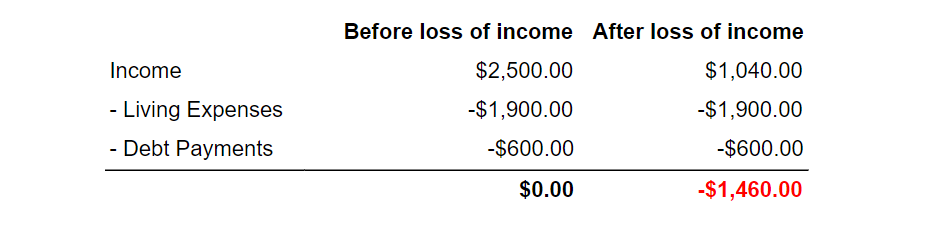

Let's illustrate this with an example:

Debbie, a single woman working in the hospitality industry, was doing okay. Her net income was $2,500/month. But last week, Debbie was laid off. She applied for and started receiving unemployment income of $1,040 per month. Here’s how her monthly budget changed due to that change in income:

Debbie knows she can’t make her credit card payments anymore — she’s barely able to figure out a new budget that allows her to keep up with rent, utilities, and food. She’s considering filing Chapter 7 bankruptcy to help deal with her new shortfall. Should she?

In Debbie’s situation, stopping all credit card payments is the same as filing for Chapter 7 bankruptcy, which will stop all credit card payments with the automatic stay.

So regardless of which option Debbie chooses, her new monthly budget will look like this:

Her monthly expenses still exceed her income by $860/month. Filing Chapter 7 bankruptcy won’t increase her income. In fact, it won’t change her current situation at all. Even if she files, she’ll still have a monthly shortfall. Since filing a Chapter 7 won’t give Debbie immediate relief from financial distress or a fresh start, it’s probably premature for Debbie to file Chapter 7 bankruptcy now.

Comments

0 comments

Article is closed for comments.