Bankruptcy exemptions protect a filer’s property to ensure they are able to take full advantage of their fresh start. While the available exemptions vary depending on the state you live in, there are certain types of common bankruptcy exemptions that are generally found in all exemption schemes. This article will provide an overview of the 7 most common types of bankruptcy exemptions and how they protect the filer’s property in a Chapter 7 bankruptcy.

Personal Property Exemptions

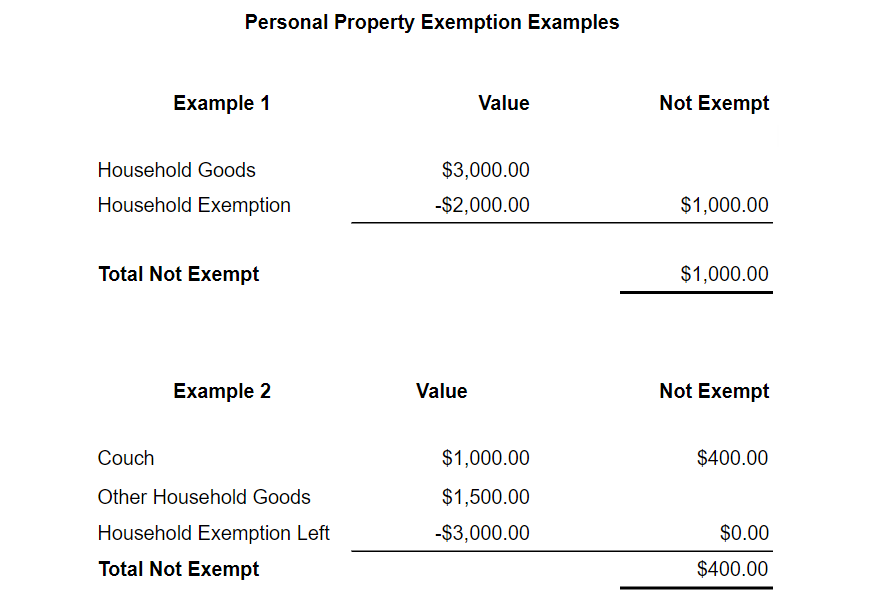

Personal property is any property that you can touch, that is not physically attached to your house or land (that’s called “real property”). Examples of personal property include your bible, your sofa, your car, etc. Intangible property is property that you can’t touch. A tax refund that you have not yet received is an example of an intangible asset. Personal property exemptions make the particular property off-limits to creditors. Since the property is off-limits to creditors, the bankruptcy trustee can't touch this property either. Often, a personal property exemption will cover an item only up to a certain value. In this case, you may only be able to partially protect that property. Some personal property exemptions are specific to one item. In most states, there is an exemption for your bible and your wedding ring. Other personal property exemptions cover certain types of property. For example, you may have an exemption to cover household goods. These exemptions may have a limit for the total value. For example, you may only be able to cover $2,000 worth of household goods. In this situation, if you have $3,000 worth of household goods, $1,000 would be unprotected (non-exempt).

Another limitation is that there may be a per-item limit on exemptions. For example, it may be the case that you have a piano that is worth $2,000. In this example, there is a maximum exemption of $1,000 per item of household goods and a $4,000 household goods exemption. If your total household goods were $3,500 in value, including the piano, you will have $1,000 of nonexempt value. This is because you are only able to apply $1,000 of the $4,000 household goods exemption for the piano.

These limitations on the exemptions exist because the law protects items necessary for a reasonable lifestyle, not luxury items.

Motor Vehicle Exemption

Another type of exemption common in most states provides protection for your car or truck. These exemptions are usually limited by dollar amount. In some states, if you don't have a high enough motor vehicle exemption to cover your vehicle, you can use your spouse's full exemption if the vehicle is jointly owned. Some states allow stacking your spouse’s exemption, but don't let you use the full exemption of the spouse. Some states allow you to use part of your wildcard exemption (discussed below) to cover what's not covered in this motor vehicle exemption.

It's important to understand that exemptions don't have to be applied to the full value of the property where you owe money for the property. If you’re still paying on a car loan, you only need the exemption to cover your equity. If your car is worth $5,000 and you owe $2,000, you have $3,000 of equity. If you have a $3,000 exemption, then your car is fully protected from your bankruptcy trustee. In this case, the property is the vehicle. In some states, if you or a dependent is disabled, you will be able to apply an increased exemption to the vehicle. Exemptions don’t protect you from the secured creditors that have a collateral interest in the particular piece of property.

Tools of the Trade

Most states have a "tools of trade" exemption. Tools of the trade are items owned by you that you use to make a living. For a doctor, a tool of trade would be their stethoscope. For a carpenter, a tool of trade would be their hammer. For a delivery driver that owns the vehicle they use for deliveries, their car or truck might be a “tool of the trade.” Like other exemptions, the tools of trade exemptions are usually limited to a certain dollar amount.

Wage Exemption

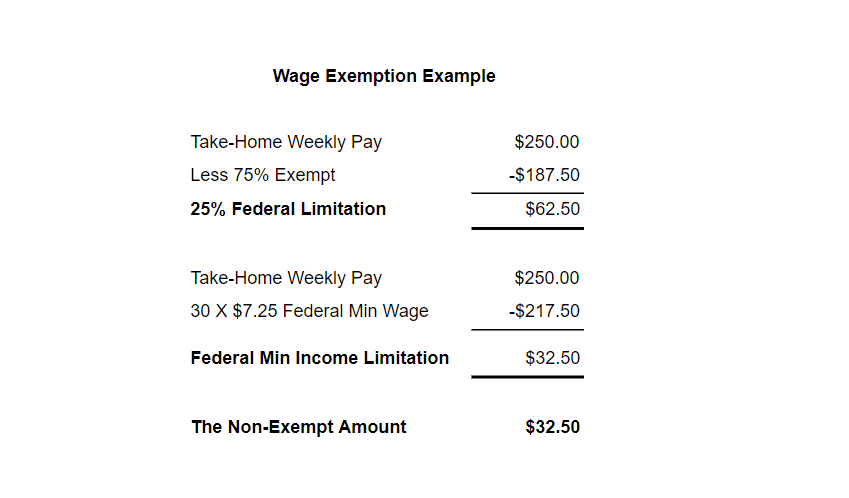

Wages earned before you file bankruptcy but received after filing bankruptcy are part of the bankruptcy estate. The wage exemption is 75% in most states. Federal wage laws provide a limitation on creditors so that they can’t take more than 25% of your income after mandatory deductions (payroll taxes, etc) or the amount by which your weekly income after mandatory deductions exceeds 30 times the federal hourly minimum wage, whichever is lower.

If your weekly net wages are $250.00, the maximum amount the trustee could get from a paycheck that’s paid after the bankruptcy filing, but for work fully performed before the bankruptcy filing, would be $32.50. The calculation is as follows: $250 X 25% = $62.25 that could be taken using the 25% calculations. However, 30 X 7.25 (the federal minimum wage) = 217.50. $250-217.50 = $32.50. Since $32.50 is less than $62.25, the trustee is limited to taking $32.50 from this paycheck. Your state law may have a higher exemption than this amount which may mean that the trustee can get nothing from this one paycheck.

Homestead Exemption

The homestead exemption is what you use to protect your home from creditors and the bankruptcy trustee. Again, it's the equity that matters. If you own a home and it’s worth $200,000, but you owe $180,000 on it, you have $20,000 in equity. If your state allows a $30,000 homestead exemption, your home is fully exempt. If your state has a $7,500 homestead exemption, you have $12,500 of nonexempt equity in your home.

Most states have a dollar limitation on their homestead exemption. A few states such as Florida and Texas have an unlimited exemption for your home. In these states, assuming you have lived in one of these states for the required amount of time to qualify for their homestead exemption, you could have a home worth $100 million and owe nothing on it and it would still be completely exempt. Even these states do have some limitations though. In urban areas of Florida, the property cannot cover more than 1/2 acre. In rural areas, it can't be more than 160 acres. Some states, such as New York, provide homestead exemptions in differing amounts depending on the county your home is located in.

There is another rule for homestead exemptions. You must have bought the home 1,215 days before filing bankruptcy to use that state's homestead exemption. Otherwise, you will be limited to $170,350 in 2020. This amount is indexed for inflation and will be updated again in April of 2022. If you live in a state with an unlimited exemption such as Texas or Florida, or a state with a homestead exemption greater than $170,350 and you haven't owned the home for the required amount of time, you will be capped at this amount. If you live in a state with a lower homestead exemption, that lower homestead exemption will be your exemption amount.

If you don't own your home, but rent, you may still be able to use the homestead exemption. In many states, you can use your homestead exemption to exempt your security deposit for the rental home or apartment where you live. Some states and the federal bankruptcy exemptions allow all or a portion of an unused homestead exemption to be used as a wildcard exemption.

Retirement Benefits

If your retirement account is an ERISA qualified account, it’s generally exempt under both federal and state law. ERISA is the Employee Retirement Income Security Act of 1974. Generally, some IRAs that aren't ERISA qualified, but qualify as IRAs under the Internal Revenue Code (IRC), are also protected. Retirement accounts have to meet a very complex set of requirements to be ERISA qualified or to meet the requirements of the IRC.

Some states have an unlimited exemption for IRAs. Unfortunately, federal law trumps state law here. §522(n) of the Bankruptcy Code limits this exemption to $1,000,000 after indexing for inflation. This amount is updated every three years. The last update was in April of 2019, and the next update will be in April of 2022. The current indexed limitation for this exemption is $1,362,800. If your state exemption is less than this amount, you will be stuck with the state exemption unless you live in a state where you can choose the federal exemptions.

If you inherit an IRA or other retirement account it isn’t exempt from your creditors or the bankruptcy trustee unless your state’s exemptions specifically state otherwise. There is an exception to this rule. If you are the spouse of the person that died and you have rolled over the inherited IRA (or another type of exempt retirement account) into your own retirement account, the funds from the inherited retirement account will be protected from your creditors and the bankruptcy trustee.

The Wildcard

The wildcard exemption protects any equity in property that's not already covered by another exemption. Most states and the federal exemptions have a wildcard exemption. Some states and the federal exemptions allow you to add any unused homestead exemption to the wildcard exemption. In the case of the federal exemptions, the wildcard exemption is $1,325 and up to $12,575 of the unused homestead exemption can be added to the federal wildcard exemption. Both of these amounts are revised every three years for inflation, with the next update set to occur in April 2022. In the example in the personal property section of this article, the nonexempt equity of the piano could be protected using an available wildcard exemption.

Conclusion

Since exemptions are what you use to protect the things you own from the bankruptcy trustee, exemptions are one of the most important parts of any bankruptcy proceeding. Most low-income bankruptcy filers have no non-exempt assets. Even if some property is non-exempt, the value of the non-exempt part would have to exceed the selling expenses to be truly at risk. In most cases where there is only a small amount of non-exempt equity, the filer loses nothing to the bankruptcy trustee in a Chapter 7 bankruptcy. If you're unsure about the exemptions you have available or how to allocate those exemptions, it's important that you consult with a bankruptcy lawyer. If it appears that you might lose some property if you file a Chapter 7 bankruptcy, it might be better to consider a Chapter 13 bankruptcy.

Comments

0 comments

Article is closed for comments.