The funds you’re expecting will be an asset of your bankruptcy estate. There is nothing in the CARES Act, the relief bill that created the stimulus, that suggests otherwise. This means the only way to protect the money is through a wildcard exemption.

If you’re not using the federal bankruptcy exemptions, note that not all states have a wildcard exemption. If you don’t have the ability to claim a wildcard exemption, you may have to turn the money over to your bankruptcy trustee.

As of April 7, 2020, the United States Trustee program has issued a notice to all Chapter 7 and Chapter 13 trustees outlining that - all things considered - they don’t expect trustees to be taking these funds from filers. They are also telling trustees to notify their office before taking any such action. If your trustee is asking you to give them your stimulus check, please let us know.

Now, if you’ve received your stimulus check and spent the funds on necessities such as rent, groceries or utilities before your case is filed, this is not an issue. If you’ve got the funds in your bank account when you file, it’s treated just like any other funds in your bank account. In that case, as long as the full amount is covered by an available exemption, you’ll be able to keep the money.

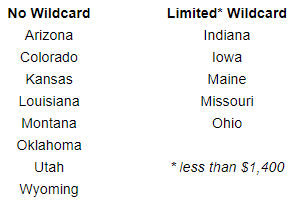

For ease of reference, please note that the following opt-out states (states that do not allow the use of the federal bankruptcy exemptions) have limited or no wildcard exemption:

Comments

0 comments

Article is closed for comments.