Depending on how long you’ve had a debt, there may be multiple creditors attached to it. Whether the debt was sold to different collection agencies over the years or you’re being sued by a creditor, it’s important to list all the parties involved so they can be notified of your bankruptcy filing and stop trying to collect payment.

Which Creditor Do I List if My Debt Has Been Bought and Sold by Different Collection Agencies?

It’s best to list all the collection agencies that you know of that are attached to a debt, especially if you’re not sure who owns the debt today. Listing them all ensures they’ll all be notified. If they no longer own the debt they’ll ignore the notice.

How Should I List Multiple Creditors for the Same Debt?

List the original creditor with the current balance you owe. You may have to look back at your documents to find out who you owed the debt to first. If a debt is more than five years old, you may want to search online to see if the creditor’s address has changed.

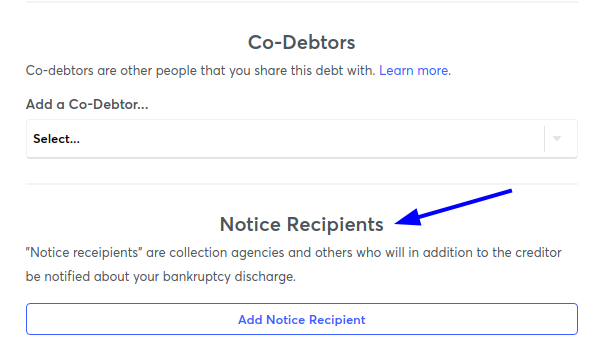

Then, list each collection agency as an additional "Notice Recipient" at the bottom of the screen. You'll see this underneath the co-debtor section in the questionnaire:

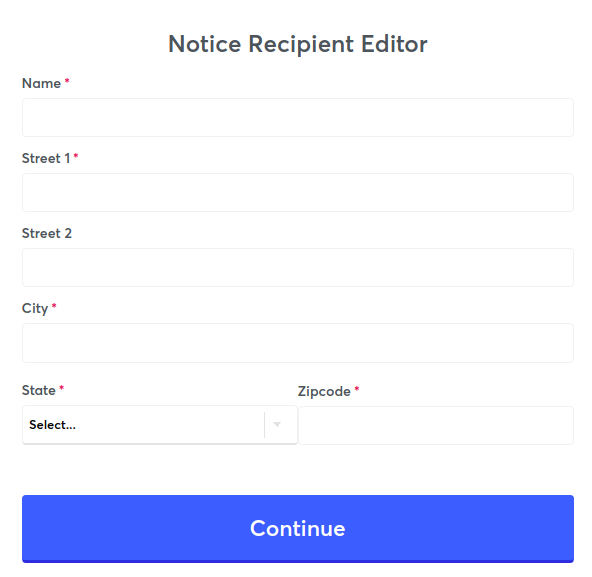

This will bring you to this screen where you can add the name and mailing address of the additional party connected to the debt:

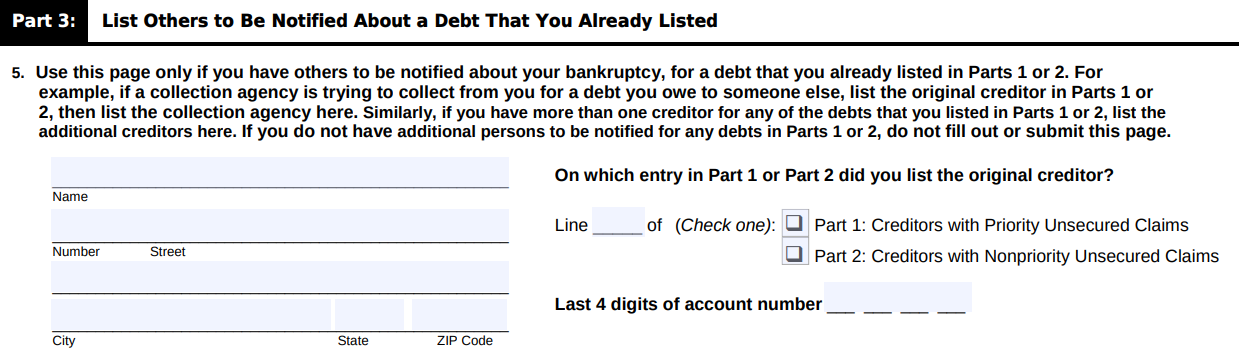

You'll notice that you only need to add the collection agency’s name and mailing address, but you don’t need to add an account number, balance owed, or any of the other information you need for the original creditor. That's because these additional notice recipients will be listed in Part 3 of Schedule E/F, which looks like this:

The software will automatically fill in the information on the right.

It’s important to do this to ensure that every party trying to collect a debt from you is notified about your bankruptcy filing, even if they're not the original creditor.

What if I’ve Been Sued? Who Do I Have To List?

If you’ve been sued, you also have to make sure to list the attorney for the bank as an additional notice recipient. This is especially important because the attorney is the one handling the lawsuit against you, not the bank or credit card company.

How Do I Find Out the Attorney’s Name and Mailing Address?

When you get sued, the creditor or its attorney must serve you with a summons and complaint. You can look at those documents or any other documents that they may have filed in court to find the attorney’s name and contact information (including their mailing address).

If you can’t find the address on any of the documents related to the lawsuit, see if you can look up the case on the civil court’s website where the case was filed. This should at least give you the name of the attorney. You can always call their office to find out their mailing address.

Is It Too Late To Add These Creditors?

If you haven’t filed yet, you can go back into the case editor in your my.upsolve account to add the additional creditors for the debt. You should also review these steps on how to add a creditor after filing. For more information about what to do if you’re being sued by a creditor and have an upcoming court date read this article.

If you’ve already filed, the first thing you should do is send a copy of the Official Form 309A (Notice of Chapter 7 Bankruptcy) to everyone you missed. The court will send Official Form 309A to you about a week after you file. Sending this form at least lets the creditor and the attorney know that you’ve filed.

It’s Just One Debt. Why Is It So Important That I List All Creditors for That Debt?

There are several reasons why it’s important not to leave out a creditor, but the main point is that if you don’t list them, they won’t get a notice from the court. If they don’t get a notice from the court, they won’t know that you’re protected by the automatic stay until and unless you tell them about it.

Comments

0 comments

Article is closed for comments.